News

U.S. Plans to Reinforce Domestic Infrastructure & the Global Demand for Ocean Containers

Add to my favorite

2021-11-01

by Sabrina Rodriguez

Data note: The data for this article is derived from the US Census trade statistics. US Census trade statistics analysis import and export on all modes of transportation. That value is calculated in USD by general CIF for imports and FOB for exports. Fasteners in this article are defined as any product under HS Code 7318 (screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter pins, washers and similar articles of iron or steel).

Much of all international trade continues to be moving across the vast oceans on massive vessels containing upwards of 25,000 tons of goods. It’s no surprise that foreign trade depends on the reliable (although not always timely) delivery of good via maritime transport. Alternatively, air cargo ships continue to dominate the market of sensitive and costly commodities such as pharmaceuticals, flowers and even a variety of high-priced produce and seafood. The U.S. has arguably become the epitome of capitalism. Capitalism, which can often lend itself to be seen as an incredibly consumer centric and materialistic society, is opening a floodgate into one of the more incredibly complex supply chains. With fast and affordable fashion, increasingly higher demands for electronic goods and an extraordinary shift in demand for new residential housing construction, the U.S. is finding itself in a never-ending demand for imports. There is a demand for semiconductors used in laptops and tablets, lumber to maintain the current housing market boom and medical health equipment replenish the healthcare industry as another wave of COVID-19 cases begin to emerge. With this shift in demand comes the need for an increase in vessels and containers. Will the primary shipbuilding companies begin to prioritize and accelerate the construction of new vessels based on the existing market?

Additionally, President Biden recently unveiled his 4.5 trillion-dollar infrastructure plan which includes improving the country’s sustainability, investment in highways and transit infrastructure, and generate projects related to clean water and broadband internet. It’s not exactly the Green New Deal, but it is a step in the right direction when it comes to cleaner energy and agriculture. The potential increase in infrastructure will not only be key for job creation for both American’s and foreigners alike, but also the demand for fasteners and other commodities used for manufacturing. It’s still difficult to tell whether this newly proposed plan will fall into place accordingly, however, it is predicted the number of bridges and public transit systems will lead to an abundance of foreign fastener trade.

Are Shipbuilders Accelerating Their Manufacturing Efforts to Keep up with Global Demands?

China, South Korea, and Japan are powerhouses in the shipbuilding industry as China Shipbuilding, Mitsubishi and Hyundai remain global leaders. It’s relatively safe to say cruise lines are not in the highest demand considering so many cruise ports around the world have not resumed operations for cruise lines. This leaves shipbuilders to primarily focus on freighters which transport cargo and bulk carriers which also transport cargo. Bulk carriers vary from regular cargo ships as bulk carriers transport unpackaged commodities such as oil, ore, coal, and grains.

According to Statista, the current prediction is for the shipbuilding market to decline to a value of around 150 billion USD during the year 2020 – 2021, and then it will surpass the 160 billion USD value by the year 2023. The Wallstreet Journal recently reported an influx of new ship orders being reported by the major shipyards. VesselsValue Ltd. reports of these major shipyards claim those in China and South Korea are inundated with new demands. Hyundai executives reported the existing demand being the highest it’s been in 20 years, and that is considering their facility is operating at full capacity. While the demand is at an exponential high, the supply for steel is largely in question. According to China State Shipbuilding Corp., the price of steel is increasing. A cargo ship requires somewhere between 25,000 and 30,000 tons of steel which is about 30% of a vessels overall cost. For reference, a bulk cargo ship (also referred to as a large crude carrier) used to cost around $85 million USD to build back in October of 2020. Due to the increased cost of steel, that same type of vessel will now cost upwards of $100 million USD.

With an increased number of ocean vessels expected to take sail sometime between 2022 and 2023, major ports around the world will need to invest into their own infrastructure to expand terminal availability. According to Datamyne, major U.S. ports have already begun to experience congestion in the harbors, delaying expected arrival dates and increasing freight rates. In some instances, cargo ships have had to make alternative routes into nearby ports due to the congestions in the harbor and the potential delay this would cause the vessel in accordance with the remainder of its sailing schedule. Los Angeles/Long Beach, California, which serves as one of the largest ports on the western seaboard of North America, experienced over a month-long congestion period earlier this year.

U.S. Infrastructure Plan –

What does This Mean for Fastener Trade with the U.S.?

If you’ve traveled to any metropolitan city inside the U.S. (albeit New York City and the surrounding area) and have had the pleasure of experiencing the public transit system, you would have quickly realized the lack of reliability due to a poorly developed and underfunded system. For city dwellers in the New York City area, public transit is both a blessing and a curse, of which the millions of users would agree requires an overhaul of improvements. High-speed trains continue to be a novelty only witnessed in futuristic movies (or Europe and Asia), while major highways continue to be deemed as ‘under construction’ for what feels like decades.

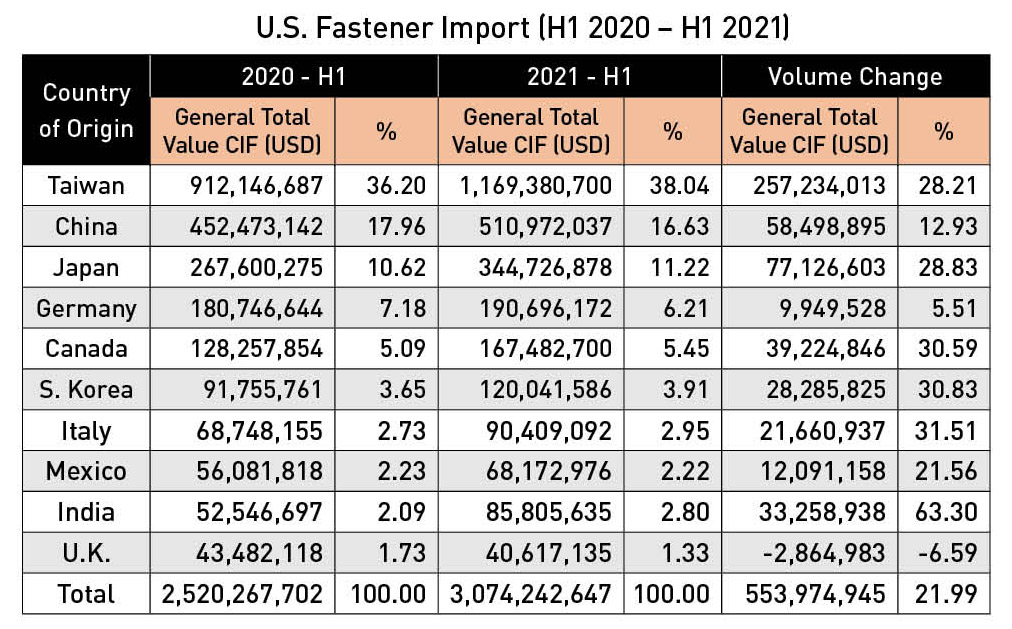

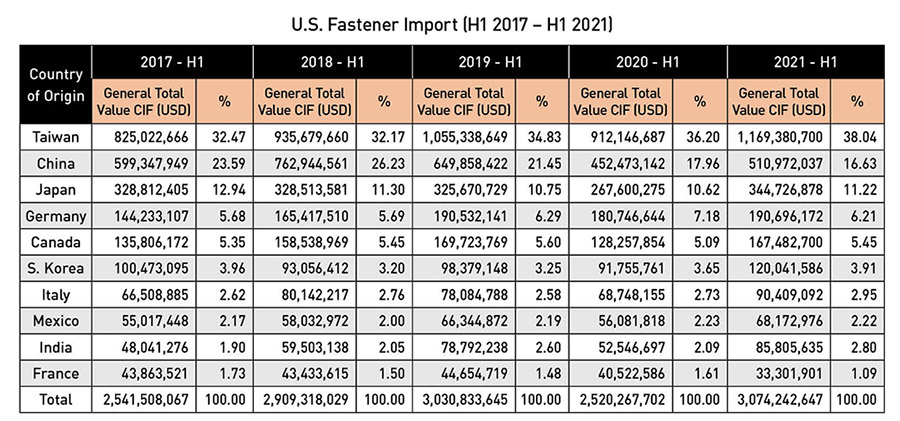

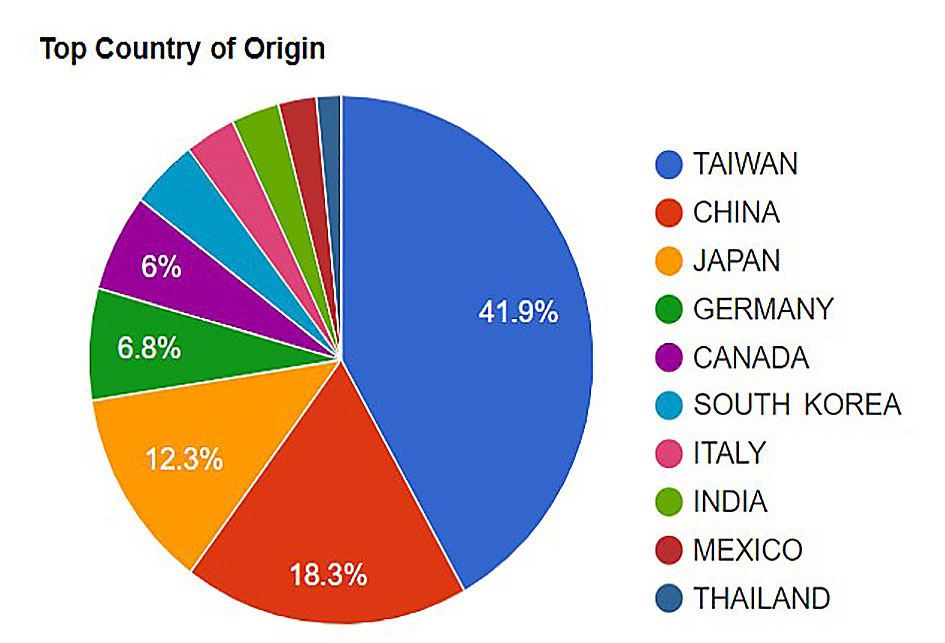

During the first half of 2021, the U.S. has imported a total value of over 3 billion USD worth of fasteners by comparison to 2.5 billion during the first half of 2020. This is a 22% increase in value in 2021 which is outstanding. The first half of 2020 was deemed a very difficult time frame due to the pandemic, however, it’s already been proven that fastener trade has substantially recovered. The top 3 foreign trading partners supply the U.S. with fasteners are Taiwan, China and Japan which collectively make up between 60 to 65% of the total market. With the consideration of new infrastructure including bridges and public transit systems for major metropolitan cities and the increase in fastener demand that has been increasing steadily over the last 5 years, the total quantities of fasteners could potentially increase between 5% and 10% on an annual basis.

Recap

Like most moving puzzles, the supply chain continues to be pieced together by the increased global demand and widespread fluctuations in the marketplace. Several different factors within the supply chain need to work together to make the introduction of newly built vessels. The same can be said about an increase in U.S. domestic infrastructure – in theory the proposed budget is outstanding, however, there are many moving pieces which can alter the expectations and results.

u.s. plans

infrastructure

shipbuilding

comntainers

美國基建計畫

建築

造船

扣件

國際展會

惠達雜誌

匯達實業

外銷媒合

廣告刊登

螺絲五金

五金工具

紧固件

台灣扣件展

印度新德里螺絲展

越南河內螺絲展

墨西哥瓜達拉哈拉螺絲展

美國拉斯維加斯螺絲暨機械設備展

波蘭克拉科夫螺絲展

義大利米蘭螺絲展

德國司徒加特螺絲展

wire Dusseldorf

FASTENER FAIR INDIA

FASTENER FAIR VIETNAM

FASTENER FAIR MEXICO

FASTENER POLAND

FASTENER FAIR ITALY

FASTENER FAIR GLOBAL

FASTENER WORLD

READ NEXT

Subscribe